Rational Reaction: 2025 Year in Review

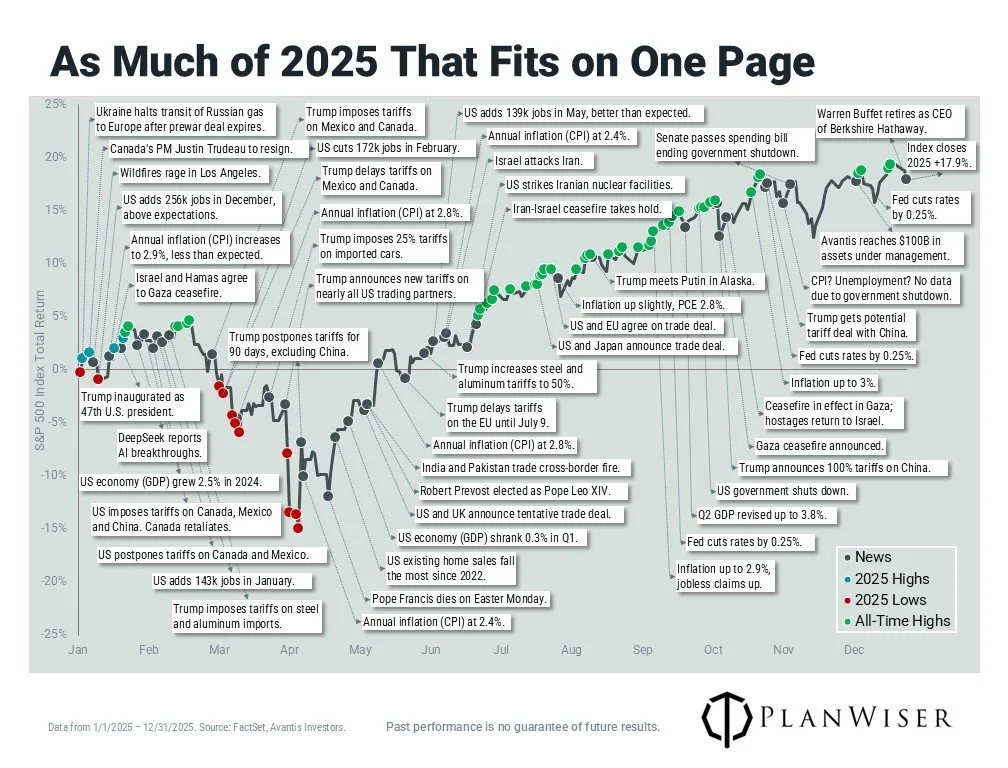

It was another remarkable year for the U.S. stock market in 2025. The S&P 500® Index rose nearly 18% with 46 new all-time highs during the year!

While undoubtedly a good outcome, a single return figure fails to capture the full experience of investors. The one-page summary of the year helps fill in the gaps, capturing major headlines from the year atop the cumulative return of the S&P 500.

What’s clear is that the strong market performance during the year occurred despite numerous examples of news contributing to investor uncertainty, and, critically, earning these returns required discipline.

Consider that between late February and early April, the S&P 500 fell nearly 19% based on end-of-day closing prices. On April 7, the index briefly dipped into bear market territory, with a decline of more than -21% from its late February high.

During that drawdown period, the index declined 6% in a single trading day, following the announcement of new tariffs on nearly all U.S. trading counterparts on April 3. When most of those new tariffs were paused less than a week later, the market surged almost 10% in one day, kick-starting a recovery that took just 54 days to claw back losses from the drawdown.

This is a fascinating view of the year on just one page.

Disclosures

Consumer Price Index (CPI): Measures the average change over time in the prices paid by urban consumers for a fixed basket of goods and services. It reflects out-of-pocket spending by households on items such as food, clothing, shelter, and medical care.

Federal Reserve (Fed): The U.S. central bank responsible for monetary policies affecting the U.S. financial system and the economy.

Gross domestic product (GDP): Measures the total economic output in goods and services for an economy.

Personal Consumption Expenditures (PCE): Measures the average change in prices of goods and services consumed by individuals in the United States. It includes a broader range of expenditures, such as those made on behalf of households by non-profit institutions and government programs. The Federal Reserve prefers PCE for setting monetary policy because it provides a more comprehensive view of inflation and consumer behavior.

S&P 500® Index: A market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The index is widely regarded as the best gauge of large-cap U.S. equities.

Treasury yield: The effective annual interest rate that the U.S. government pays to borrow money through the issuance of its debt securities, such as Treasury bonds, notes, and bills. It is expressed as a percentage and represents the return investors can expect from holding these government securities until maturity.

PlanWiser Financial, nor any of its members, are tax accountants or legal attorneys, and do not provide tax or legal advice. For tax or legal advice, you should consult your tax or legal professional. Tax services are offered independently through PlanWiser Tax. This is being provided for informational purposes only, and should not be construed as a recommendation to buy or sell any specific securities. Past performance is no guarantee of future results, and all investing involves risk. Investment advisory services offered through PlanWiser Financial, LLC, a Registered Investment Adviser.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of the portfolio team and are no guarantee of the future performance of any Avantis fund. This information is for an educational purpose only and is not intended to serve as investment advice. References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.